India’s economic warfare – suspension of Indus Waters Treaty, ban of imports, ships and parcels – have left investors in the Pakistan stock markets rattled. Add to that Operation Sindoor carried out by the Indian armed forces on May 7 to target nine terrorist facilities in Pakistan and Pakistan occupied Kashmir. Indian stock markets, on the other hand, have actually rallied smartly.

India vs Pakistan Stock Markets: How Have Nifty 50, BSE Sensex Performed Since April 22?

Indian stock market indices, Nifty 50 and BSE Sensex, have actually risen strongly since April 22, 2025. On a day when the Indian armed forces conducted Operation Sindoor, carrying out precision military strikes on Pakistan terrorist facilities, the Indian stock markets actually closed in green!

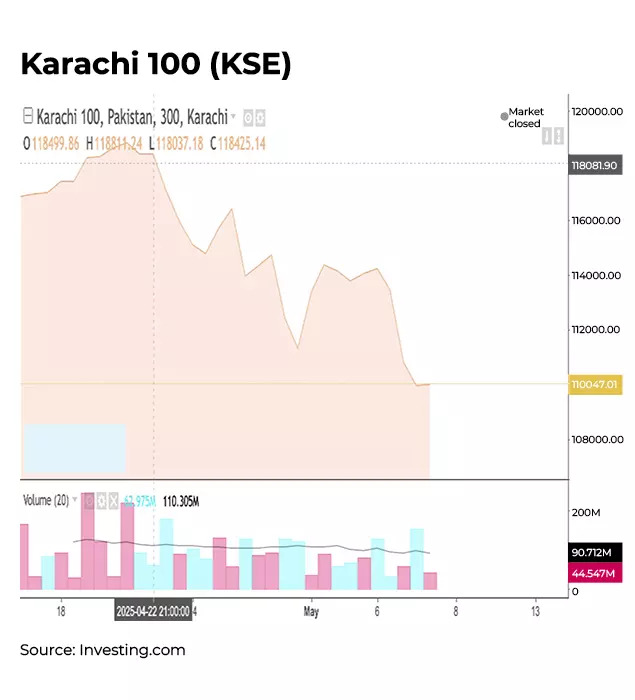

Pakistan stock market in contrast has crashed over 6% in the last two weeks. The Karachi Stock Exchange index KSE 100 tanked over 5% in trade today, the day of Operation Sindoor, before closing over 3% down.

Dr. VK Vijayakumar, Chief Investment Strategist, Geojit Investments Limited tells TOI, “Since the Pahalgam attack the Karachi index is down over 6% while the Nifty is up around 1%. The fact that the Nifty closed in the positive territory today while the Karachi index is down is an indication of the higher vulnerability of Pakistan.”

Historical context:

Despite a history of military tensions between India and Pakistan, including the 1999 Kargil conflict and the 2001 Parliament attack, research by Anand Rathi indicates that Indian markets have remained largely unaffected by such events. Their analysis reveals that market corrections were predominantly influenced by global economic factors rather than regional conflicts.

Historical data analysis by Bajaj Broking shared in an ET report reveals that across five significant cross-border incidents since 1999, including Kargil, Uri, and Balakot, the Nifty 50 demonstrated remarkable stability with an average decline of only 5.27%, subsequently delivering returns ranging from 7% to 19% over six-month periods.

Also Read | Big economic setback! Pakistan economy has more to lose than India – Moody’s warning amid ongoing tensions

Pakistani markets exhibit greater susceptibility to fluctuations during such events, reflecting underlying economic vulnerabilities rather than direct conflict impacts. The limited trading activity results in swift withdrawals by international investors when risk perceptions increase.

India vs Pakistan: It’s All About the Economy!

The biggest reason for the resilience of the Indian stock market is the underlying fundamental strength of the economy. India is currently the world’s fifth largest economy and is on its way to become the fourth largest, overtaking Japan this year. The Indian economy is also the world’s fastest growing major economy.

In contrast, the Pakistan economy is in a dire state. At the mercy of bailout packages from the International Monetary Fund, Pakistan’s economy is teetering, and any signs of improvement in the last few years are at risk with India-Pakistan tensions escalating.

Vijayakumar of Geojit added, “The message from the market, so far, is that an extended conflict between the two nations is unlikely. Pakistan, which has been slowly climbing back from a serious economic crisis in 2023 with the help of an IMF bail out, cannot afford an extended conflict with India, which has a strong economy and healthy macros. A war with India will bankrupt the Pakistan economy and, therefore, the Pakistan administration will be keen to avoid it.”

The contrasting market responses highlight the distinct perceptions global investors hold towards these neighbouring economies: India stands out as a comparatively stable market with robust growth potential and steady capital influx, whilst Pakistan is viewed as a high-risk frontier economy struggling with inflationary pressures, IMF reliance, and unstable governance.

Also Read | Real economic blow to Pakistan! India chokes $500 million Pakistani goods entering it via third countries

The robust performance of Dalal Street can also be attributed to substantial Foreign Institutional Investors (FII) participation, with Rs 43,940 crore in FII investments during the previous fortnight providing significant market support.

The stability of Indian markets is underpinned by strong domestic investment participation. Current retail investor engagement remains high, domestic mutual funds maintain substantial cash reserves, and options market indicators suggest stable short-term conditions.

Conversely, Pakistan confronts multiple challenges including diminishing growth, currency instability, and possible credit rating reductions without sustained IMF backing. Despite attractive equity valuations, the market suffers from persistent international investment outflows and minimal institutional involvement.

In a note, global rating agency Moody’s has warned that heightened tensions between the two countries will hit Pakistan harder than India.

“Sustained escalation in tensions with India would likely weigh on Pakistan’s growth and hamper the government’s ongoing fiscal consolidation, setting back Pakistan’s progress in achieving macroeconomic stability. Pakistan’s macroeconomic conditions have been improving, with growth gradually rising, inflation declining and foreign-exchange reserves increasing amid continued progress in the IMF programme. A persistent increase in tensions could also impair Pakistan’s access to external financing and pressure its foreign-exchange reserves, which remain well below what is required to meet its external debt payment needs for the next few years,” Moody’s said.

“Comparatively, the macroeconomic conditions in India would be stable, bolstered by moderating but still high levels of growth amid strong public investment and healthy private consumption,” it added.