NEW DELHI: Amid fears of a surge in imports from China, the latest data available showed that electronics exports to India, as well as the US, fell in Jan and Feb. While these numbers provided comfort to Indian policymakers, trends in recent weeks – after Trump’s tariff actions – also did not show any surge, with a high-level group monitoring shipments from China and Asean, sources familiar with the stepped-up vigil said.

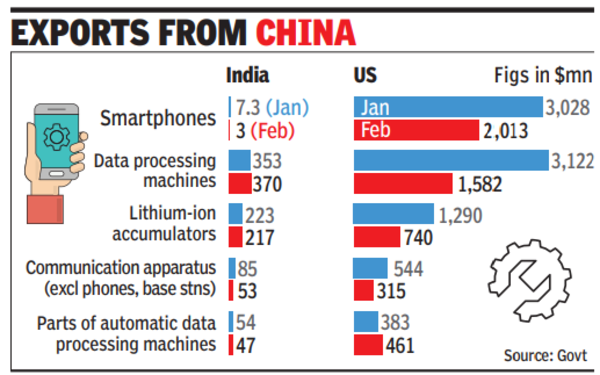

The value of the top 10 electronics products exported by Chinese companies to India stayed at $1.8 billion during Jan and Feb. As US President Donald Trump took office at the end of Jan, imports into America halved. In Jan, Chinese shipments of the top 10 electronics items were estimated at $10 billion, which fell to $6 billion in Feb. A part of the reason for the fall could be front-loading of exports by China.

China is the biggest source of imports for all goods for India as well as the US, and both run a massive trade deficit, which in India’s case was almost $100 billion during the last financial year and remained unabated, despite govt’s repeated moves to keep it under check. Electronics, chemicals, steel, consumer durables and other consumer goods are among the top items being monitored by a committee of officials from commerce, revenue, and industry departments along with other ministries.

The panel was set up after domestic industry and experts raised alarm bells around a possible surge in imports from China and Asean, many of whose members are seen as proxies for Beijing, as supplies to the US markets became more expensive with tariffs kicking in. “Close monitoring is happening, and so far, there has not been any significant surge,” an officer said. The full impact of tariffs is, however, expected to kick in only after a few months.

A section of Indian industry, especially the small players, however, believes that a lot of the fear expressed by large players is unwarranted. For instance, they argued steel giants created a major noise over a possible import surge from China and lobbied hard with govt to get a 12% safeguard duty on several products. With the duty in place, they increased prices in the domestic market by 10%. The small players said there is little chance of Chinese steel coming into India, given the stringent BIS registration requirement, but a bogey was created, which govt fell for even at the ministerial level.