India’s Rs 17,000 crore production-linked incentive programme for IT hardware is beginning to yield results as several brands previously reliant on China establish partnerships with domestic contract manufacturers for laptop production in India.

These collaborations come against the backdrop of escalating trade tensions between China and the US. Despite the Donald Trump administration’s current exemption on IT hardware imports from China, companies are hastening their discussions for local manufacturing arrangements with Indian firms, driven by concerns over potential sector-specific tariffs anticipated in May.

Indian manufacturers are enhancing their production capabilities whilst offering global brands advantages through reduced tariffs and incentive schemes. Additionally, they provide opportunities to participate in government contracts requiring 20-50% local content.

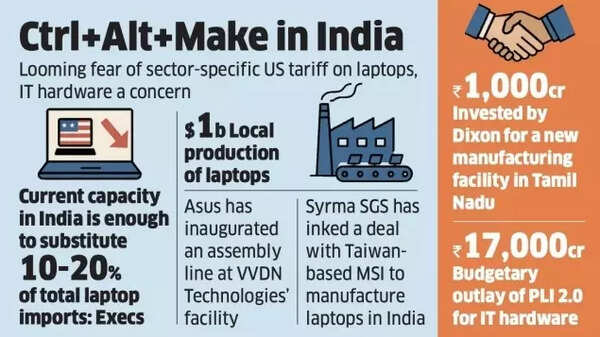

Industry sources told ET that present manufacturing capacity in India could replace approximately 10-20% of total laptop imports, which reached $11 billion in FY2024. Current domestic laptop production stands at roughly $1 billion, as per industry statistics.

Make in India

The Production Linked Incentive (PLI) 2.0 for IT Hardware, introduced on May 29, 2023, features a Rs 17,000 crore budget allocation across six years. The programme offers approximately 5% incentive on net incremental sales of locally manufactured products. Manufacturers must increase component localisation annually to secure additional incentives.

The government anticipates that PLI 2.0 will attract Rs 3,000 crore in investments, generate Rs 3.5 lakh crore in production value, and create 47,000 jobs nationwide.

Asus recently launched an assembly line at VVDN Technologies’ Manesar facility after six months of discussions regarding scalability and localisation. According to Gourab Basu, senior vice president at VVDN, who spoke to the financial daily, their current production line produces one laptop every 240 seconds.

Also Read | Elon Musk’s Tesla eyes India to diversify its global supply chain; in talks with CG Semi, Micron

“Our commitment to India is very, very strong,” Dinesh Sharma, vice president, commercial PC and smartphone system business group, ASUS, said. “When you are trying to shift your production supply chain, cost efficiency is a matter of concern. And the more backward integrations we can get, the better”.

Gurugram-based Syrma SGS has established an agreement with Taiwan-based MSI for laptop manufacturing in India, responding to stricter import regulations. As a participant in the IT hardware PLI, the contract manufacturer recognises the opportunity for Indian companies to benefit from the shift away from high-tariff nations such as China and Vietnam.

“We in the industry should catch the bull by its horns and take this opportunity to develop the ecosystem of components base in India,” said Jasbir Singh Gujral, managing director, Syrma SGS, noting that the organisation will consider capacity expansion to attract additional laptop brands for exports.

Dixon Technologies has allocated over Rs 1,000 crore towards establishing a new manufacturing unit in Tamil Nadu for HP Inc laptop production. The facility, scheduled to commence operations in May, will initially produce two million laptops yearly. Additionally, Dixon has contracted with Lenovo and Asus for laptop production at this location, whilst already producing 25-30% of Acer’s domestic requirements at their Noida facility.

Government statistics indicate that as of December 2024, PLI has attracted Rs 520 crore in investments, achieved Rs 10,000 crore in production value, and created 3,900 employment opportunities.

The programme has experienced limited participation, as international companies continue importing most of their Indian sales volume, benefiting from China’s 4-5% manufacturing cost advantage prior to tariff implementation. Despite China’s established cost-effective ecosystem, global companies are now actively developing a comparable infrastructure in India as an alternative manufacturing base.

Also Read | Donald Trump tariffs push Chinese giants to bow to India’s terms

India’s laptop exports remain constrained due to stringent US product testing requirements. An executive pointed out that India lacks appropriate testing facilities, necessitating product shipments to Shanghai’s nearest laboratory for US export certifications, resulting in additional expenses.

Asus’ Sharma indicated the company’s consideration of encouraging their global component suppliers to establish Indian operations, expressing willingness to share these suppliers with VVDN to support their backward integration initiatives.

VVDN reported ongoing manufacturing of various components and modules, including Wi-Fi antennas, camera modules, memory packaging, display assembly, mechanical inclusions, and additional items. The company intends to establish a printed circuit board manufacturing facility.